avalara tax codes by state

State sales tax rates at your fingertips. E-invoicing is the process of creating and providing an invoice in a digital format.

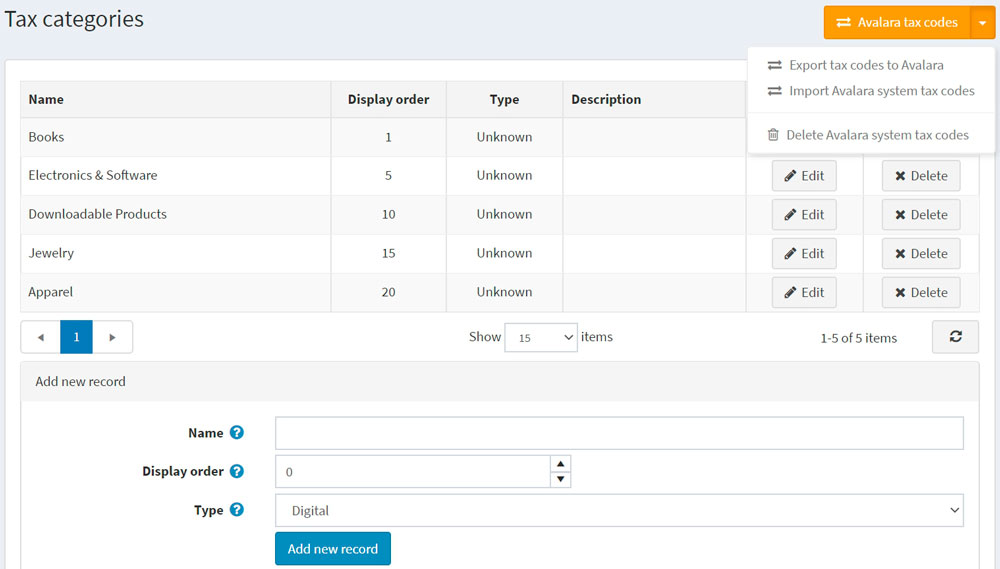

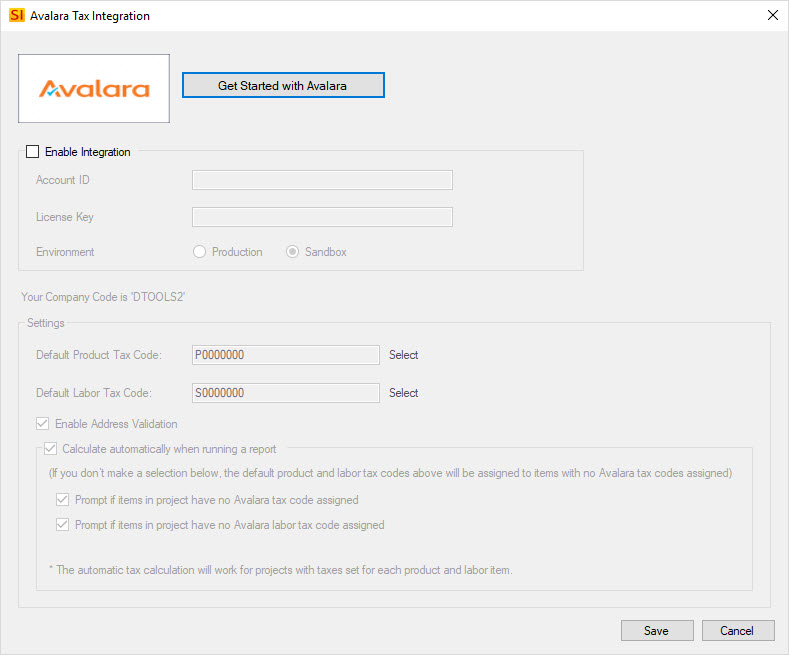

Avalara Tax Integration D Tools

Find the average local tax rate in your area down to the ZIP code.

. The jurisdiction breakdown shows the different sales tax rates making up the combined rate. Next to Custom Rules select Manage. This change was effective in Avalara products on April 1 2018.

Streamlined Sales Tax SST is a state-run program designed to make sales tax compliance easier and more affordable by offsetting the cost of using a tax technology provider like. Ad Solutions to help your business manage the sales tax compliance journey. Select Custom Tax Codes and then select Add a Custom Tax Code.

The boundaries can change and often dont line up with tax rate jurisdictions. Simply click on your state below and get the. These tax codes are taxed at the full rate.

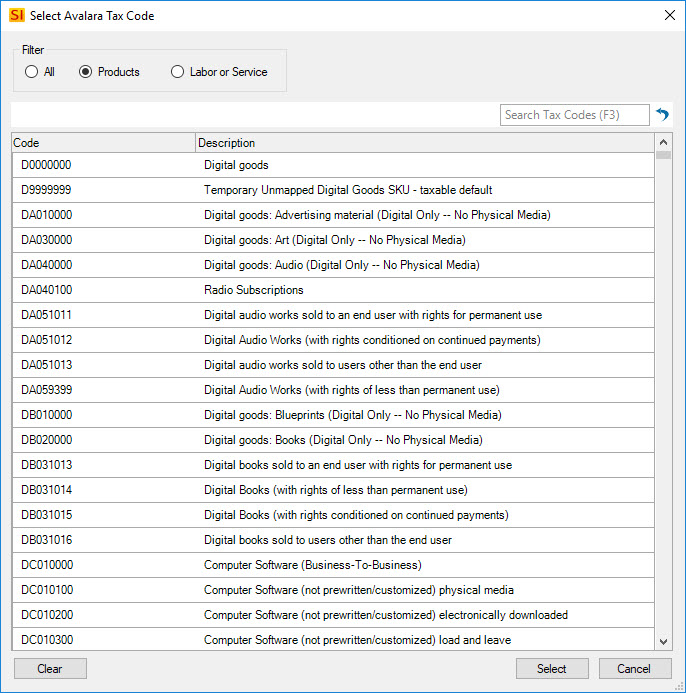

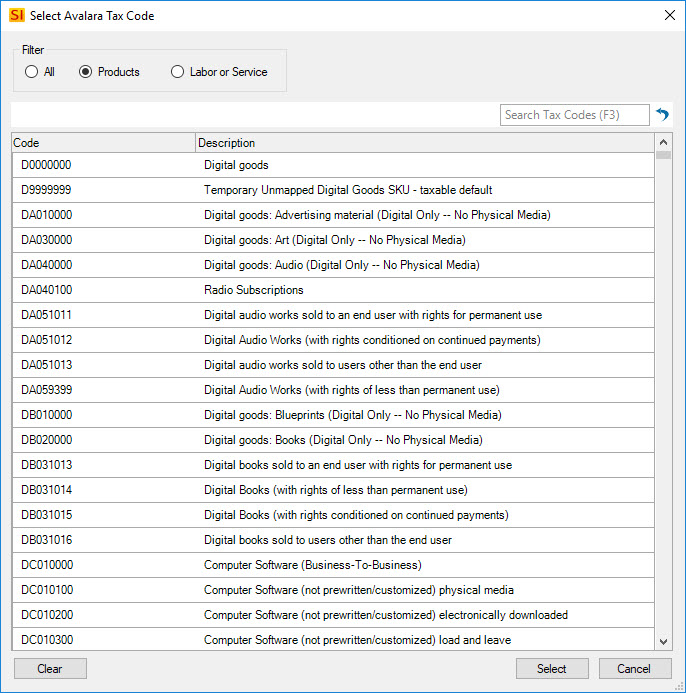

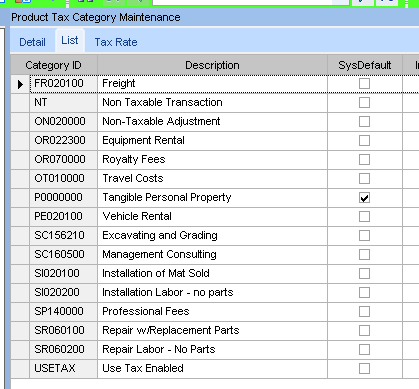

You can use this search page to find the Avalara codes that determine the taxability of the goods and services you sell. Industrial production or manufacturers. We help companies to transact comply and grow with confidence.

The digitisation of tax reporting - a global tracker. Find the Avalara Tax Codes also called a goods and services type for what you sell. AvaTax uses these values to identify tax jurisdictions and apply the correct tax.

Every tax jurisdiction in AvaTax is assigned a unique jurisdiction ID code and name. You can copy and paste a code you find here into the Tax Codes field in. Learn how Avalara can help your business with sales tax compliance today.

77 rows Sales tax. In AvaTax go to Settings All AvaTax Settings. Ad Solutions to help your business manage the sales tax compliance journey.

The combined tax rate is the total sales tax rate of the jurisdiction for the address you submitted. To ensure accurate tax calculation Avalara. Add up to 20 tax codes.

Learn how Avalara can help your business with sales tax compliance today. Theyre useful in states like. You can use this search page to find the Avalara codes that determine the taxability of the goods and.

Ad Industry Leading Sales Tax Solution. From SAF-T to e-invoicing tax authorities around the world are increasingly demanding detailed electronic VAT transactional reporting. You can either start typing and select from the list of available tax codes or paste the appropriate tax code.

Ad Industry Leading Sales Tax Solution. We help companies to transact comply and grow with confidence. You can copy and paste from an Excel file or separate each.

Avalara is pleased to offer simplified state-specific sales tax rate details for your business and filing needs. This makes them the wrong tool to use for determining sales tax rates in the United States. P0000000 and U0000000 are generic codes that are used when you have items that arent mapped to an Avalara tax code.

By basing sales tax. 149 rows AvaTax for Communications supports tax calculation for a number of countries states territories and provinces. Tax codes PM020704 and.

Select the states in which you do business. We publish tables based on our latest. Broadly speaking an e-invoice is exchange of an electronic invoice document between a supplier and a.

2020 Review Of Avalara Avatax Cpa Practice Advisor

Avalara Tax Integration D Tools

Avalara And Ca Partial Tax On Mfg Machinery Erp 10 Epicor User Help Forum

Understanding The Avatax For Communications Tax Engine Avalara Help Center

Software Sales Tax Use Tax Avalara